Let’s have an ERC Overview so you may benefit from the program even if you already benefited from a PPP loan. By ERC, we mean employee retention credit tax IRS program and PPP, telling Paycheck Protection Program Loan.

Learn More About The Employee Retention Credit Tax (ERC) IRS Program In This ERC Overview

The American Rescue Act of March 2021 significantly changed the employee retention credit tax (ERC or ERCT) program initially enacted in the CARES Act of May 2020.

The most up-to-date IRS legislation states that firms may qualify for the ERC even if they have already received compensation from the Paycheck Protection Program (PPP).

Many company owners must know that they may now benefit from the ERC, even if they previously received PPP money.

Is this your situation?

The change to the legislation has opened up the ERC accessibility to a much larger group of businesses.

As a result, it has become an even more valuable tool for retaining employees during these challenging times.

The ERC and PPP Interplay programs can benefit business owners, so we encourage you to learn more about them.

What is the Employee Retention Credit Tax Program This ERC Overview Is About?

The Employee Retention Credit (ERC) program has been a lifeline for many small and mid-sized businesses across the country during the COVID-19 pandemic.

The ERC provides a refundable credit against certain employment taxes equal to a different percentage depending on the year 2020 or 2021, of the qualified wages (including allocated health plan expenses) that an eligible employer pays its employees in a calendar quarter.

The pandemic has been complex for people worldwide, and the creators of this program hoped it would encourage employers to keep their workers.

For eligibility purposes, businesses must have experienced a partial or complete shutdown due to COVID-19 or have seen a significant decline in gross receipts.

Employers eligible for this program are those whose businesses have either shut down or reduced their operations, by the government’s order or have seen a significant decrease in revenue due to COVID-19.

This program has been instrumental in helping businesses keep their employees on the payroll during difficult times and has enabled them to avoid mass layoffs during periods of economic upheaval.

If you are an employer impacted by COVID-19, you may be eligible for the (ERC) Employee Retention Credit. Please visit the (IRS) Internal Revenue Service Website for more information.

Claimed credits are admissible retroactively for wages paid to employees starting in 2020 Q2 through the end of 2021 and are available to businesses of all sizes, including startups.

The maximum credit admissible is $5,000 per employee per quarter for eligible quarters in 2020 and $7,000 per employee per eligible quarter in 2021.

For Startup businesses, the eligibility extends till December 31, 2021.

It’s important to talk with IRS experts to determine admissible quarters, as they comply with any IRS updates and adjust accordingly.

The ERC has helped many companies stay afloat during these difficult times and has given them a much-needed boost as they start to rebound from the pandemic.

With so many funding options available to small business owners, it takes time to figure out where to start.

Fortunately, help is available.

We pre-qualify you for Free to confirm your eligibility to the ERC program so our IRS ERC Referral Partner Specialists can audit the employee retention credit challenging and confusing process on your behalf.

In addition, they can assist you in obtaining all the government subsidies to which your firm is entitled.

The Employee Retention Credit Tax (ERC) program audit is a great example.

But, as good things all end, it would be regrettable if you do not act before the deadlines.

With our IRS ERC Audit Services Partner (BLC), the specialization connects businesses with the funding they need to thrive. In addition, if you still need to claim or receive ERC refunds, they can get you started with the ERC program quickly and efficiently.

This program provides funding for businesses struggling to keep up with their expenses.

If you pre-qualify through our Free concise one-minute check test that you’ll find further down on this page, they can help you determine eligibility for this program and start the application process very quickly.

They will manage the program for you from beginning to end while you focus on running your business.

Their team of experts can help you navigate the eligibility requirements for government benefits and ensure you get the total amount to which you are entitled.

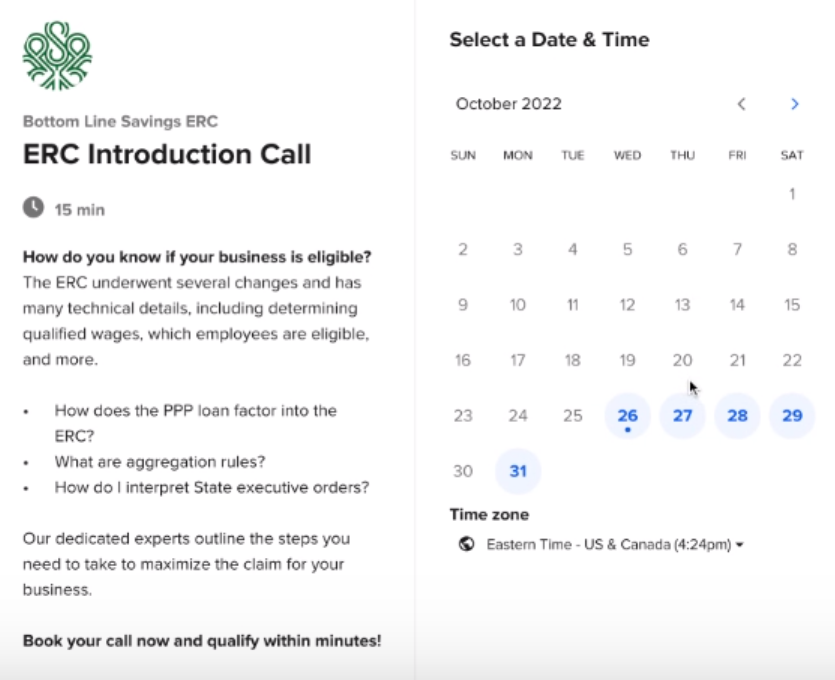

First, see if you pre-qualify for the ERC grant in five steps in under one (1) minute.

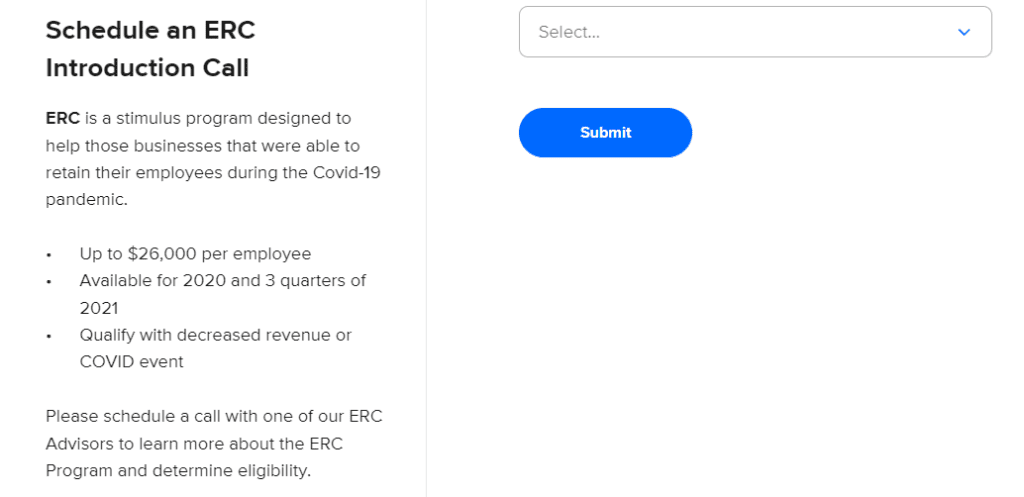

If you succeed in the pre-qualification test, you will be automatically directed to the following ERC Introduction Call Form like the one below.

Step 1. ► Click the blue arrow within the Select Bar Below

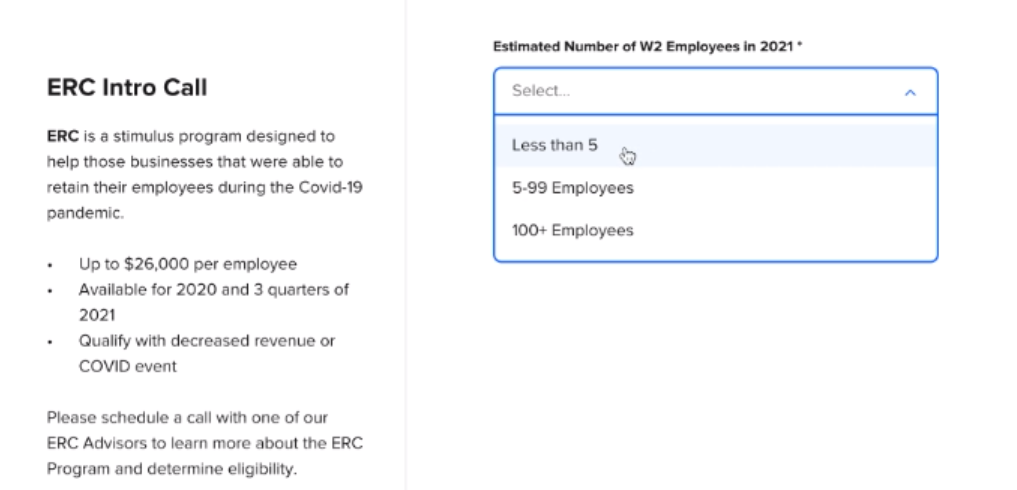

Step 2. ► Choose The Appropriate Number Of W-2 Employees

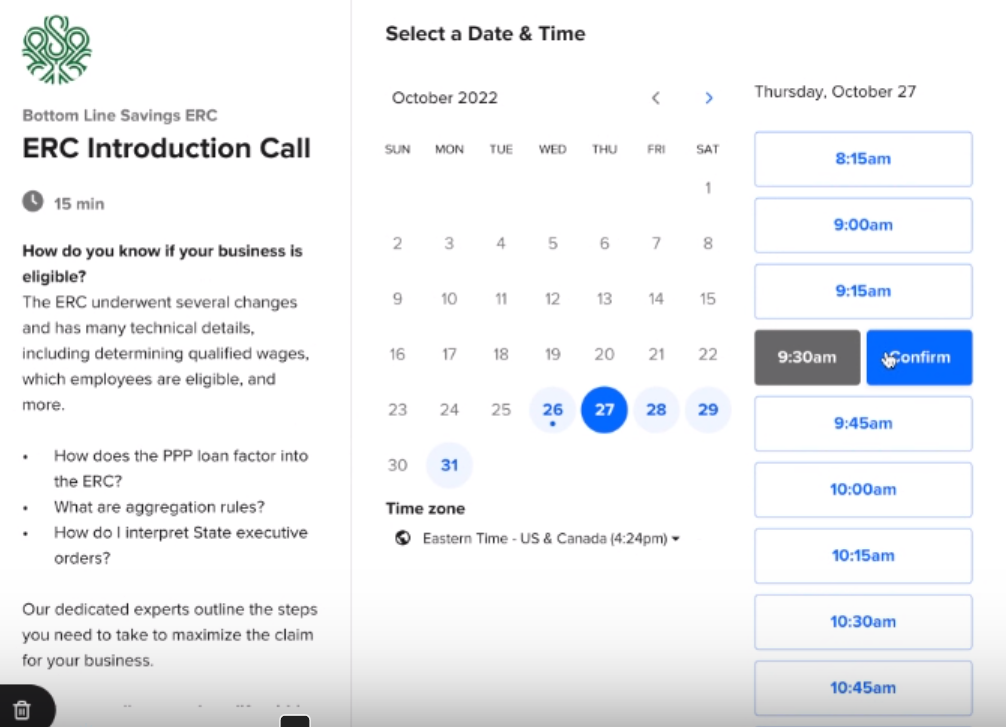

Step 3. ► Select a Date and Time That Is Convenient For You

Step 4. ► After selecting the date and time, click “Confirm“.

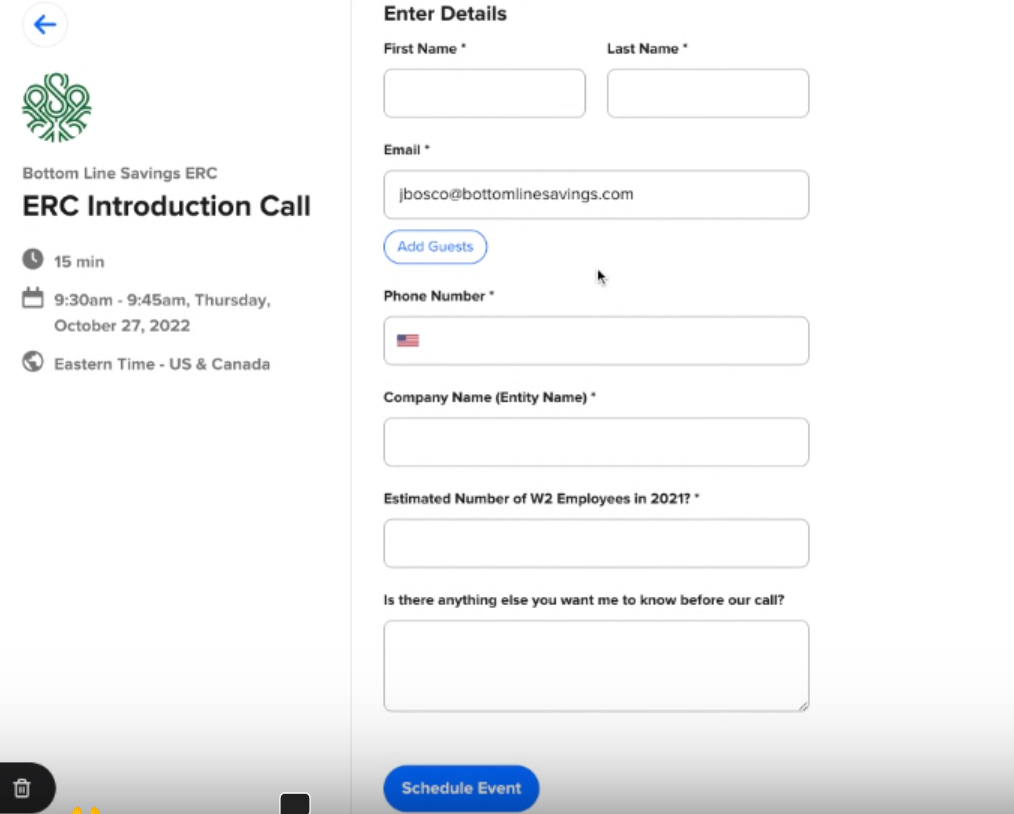

Step 5. ►You must fill out the form to schedule a Free Call with a Specialist at our Audit Services Partner to assess your unique company’s situation.

By filling out and clicking the “Schedule Event” button, you’ll be all set for your Free Call accordingly to the date and time you have set.

You will then learn more about how our Audit services Partner can help you take advantage of the employee retention credit program and claim the funds the IRS has already set aside for your business.

They would be elated to review your choices and help you find the optimal solution for your needs.

Don’t wait any longer; start your pre-qualifying check test, and you’ll know if you qualify for the program within a minute.

Thank Your For Your Time,

ERC Scope Team