What are IRS ERC Auditing Services And BLC Requirements?

IRS ERC Auditing services for the employee retention credit tax program help businesses to ensure that they comply with the program’s rules and regulations.

These ERC services also help companies to identify areas where they may be eligible for the credit and to claim the credit on their tax return.

Various firms provide IRS ERC auditing services also called the ERCT program, including accounting, law, and consulting firms.

The services typically include an analysis of the business’s tax records and a review of the business’s compliance with the ERC program’s rules and regulations.

BLC will perform expert auditing services for the Employee Retention Credit Tax (ERC) program upon a concise pre-qualification check test to schedule a Free eligibility call with one of their specialists to assess your unique business situation.

We at ERC Scope offer a concise pre-qualification check test for our referral partner, BLC, which processes the most accurate IRS ERC auditing services in the US to maximize your refund.

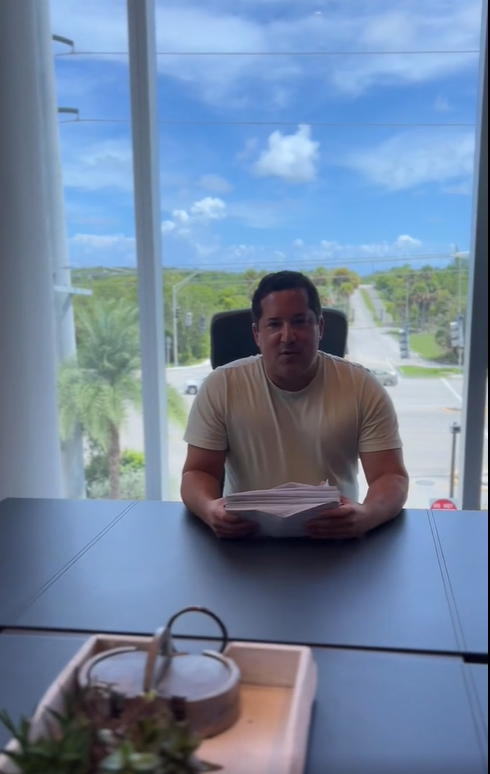

***Please, Scroll Down To View The BLC Introduction Video and A Message From Mr. Josh Fox, BLC’s CEO.

IRS ERC BLC Specialists In Auditing Services Introduction

BLC IRS ERC Auditing Services Requirements

What is BLC specialization and what is it providing?

BLC specializes in providing turn-key solutions for businesses of all sizes wanting to profit from the Employee Retention Credit Tax (ERC) program.

BLC process the Best and Most recognized IRS ERC Auditing Services in the USA, with massive success claiming the IRS ERC grants for its clientele.

It excels in any circumstance. If your business did not receive the employee retention credit on your taxes, they would get it for you.

If selected for an IRS ERC audit, their specialists will defend your case and ensure you keep every penny of the money that you are entitled to claim.

They will work with you to ensure you comply with all IRS regulations and help you maximize your credit by identifying all eligible wages. In addition, they can help you with the following:

- Filling out the necessary paperwork

- Tracking your employees’ hours and wages

- Estimating your credit amount

- Claiming the credit on your tax return

They would be happy to demystify any questions you may have.

Could Your Business Get Government Funding With ERC Auditing Services?

What do you need to meet the eligibility requirements for BLC to complete your paperwork for an IRS ERC claim?

- For BLC Services, your business must be physically located in the United States and have a Federal Employee Identification Number (FEIN).

- The Minimum number of full-time W-2 employees to qualify for BLC is five (5), excluding the business owner, spouse, or family relatives.

- The grant requirements (and BLC’s restrictions) state that you must have five (5) or more full-time W-2 employees and fewer than 501.

- Most businesses qualify for ERC since you don’t have to show a decline in revenue like with PPP loans. However, if there is a decline, the grant becomes available automatically.

- If you owned a small to medium-sized business between 03/13/2020, and 9/30/2021, the ERC would have your back if your business started before March 13, 2020; that’s even better.

- If you have already received an ERC grant or started filling out paperwork for such a grant, BLC cannot help you.

- After you complete the brief pre-qualification check test, you must schedule a FREE call and speak with a BLC IRS ERC specialist so they can understand your unique situation!

BLC only gets paid if your company receives an ERC grant from the IRS contingent upon your success.

In other words, you have nothing to lose by giving it a try; if your company is not accepted, they will be the only losers in terms of time spent.

Messages From BLC CEO Mr. Josh Fox

If you have any further questions or would like to schedule a Free Call with an IRS ERC BLC specialist to assess your unique business situation, Start your pre-qualification check test right now.

Thank you for your time!

The ERC Scope Team