When are the ERC Filing Deadlines To Claim The Employee Retention Tax Credit Refund?

The deadline for filing and applying for the ERC is April 15, 2024, for all quarters in 2020. And April 15, 2025, for all quarters in 2021.

The Department of Treasury sets these deadlines, which will not extend. Claimants must file their applications within this timeframe to receive the benefits.

The ERC is only available for the tax year ending in 2021. So if you had eligible quarters in 2020 and 2021, you must file your claim by April 15, 2024, for 2020, and April 15, 2025 for 2021.

If you have questions about the ERC or the filing process, visit the Department of Treasury.

Employee Retention Credit Tax (ERC) Is It Legit?

Eligible Quarters Start/End Dates For The ERC Program Plus ERC Filing Deadlines To Claim The Employee Retention Credit

| Eligible Quarters | Eligible Quarters Start/End Dates | ERC Filing Deadlines |

| For 2020 | From | To |

| Q1 | January 1, 2020 – March 31 | To April 15, 2024 |

| Q2 | April 1, 2020 – June 30 | To April 15, 2024 |

| Q3 | July 1, 2020 – September 30 | To April 15, 2024 |

| Q4 | October 1, 2020 – December 31 | To April 15, 2024 |

| For 2021 | **2021/Q4 Under Certain Circonstances | |

| Q1 | January 1, 2021 – March 31 | To April 15, 2025 |

| Q2 | April l1, 2021 – June 30 | To April 15, 2025 |

| Q3 | July 1, 2021- September 30 | To April 15, 2025 |

| Q4 | October 1, 2020 – December 31 | To April 15, 2025 |

Consolidated Appropriations Act American Rescue Plan

On March 11, 2021, President Biden made history by signing into law the expansive Consolidated Appropriations Act of 2021 – more commonly known as the American Rescue Plan.

This bill has provided federal assistance to individuals and businesses across the United States, including a tax credit for employee retention during the pandemic.

Companies can take advantage of this credit by filing their applications before the deadlines set out by the Department of Treasury.

The Appropriations Act American Rescue Plan also extended the timeline for companies filing for the Employee Retention Credit Tax.

To learn more about the Appropriations Act American Rescue Plan and how it affects your business, visit the Department of Treasury for more information.

If you are an eligible employer looking to file for the ERTC, stay on top of filing deadlines and take advantage of this valuable opportunity.

Don’t miss out! Verify the deadlines for filing and applying for your employee retention credit tax (ERC) refund today.

Start and get pre-qualified in under one minute to apply for employee retention.

Filing deadlines are important dates to remember! Make sure to meet all the requirements and file in time to claim your employee retention credit tax (ERC) refund.

Please see the link for more information about what you need to know about: Employee Retention Credit.

Is The Employee Retention Credit Tax (ERC) Something You’d Be Interested In Taking Advantage Of?

If so, ensure you can validate the following to be eligible for a free IRS call with a specialist to help you go through the entire process :

- You Have A Federal Employment Identification Number (FEIN)

- Is Your Business Based In The USA?

- You Were A Business Owner Operating In The USA From March 13, 2020 – September 30, 2021

- Did Your Company Have 5 to 500 W-2 Full-Time Employees From March 13, 2020, To September 30, 2021?

- Have You Already Submitted A Claim or Benefited From The Employee Retention Credit Tax Program?

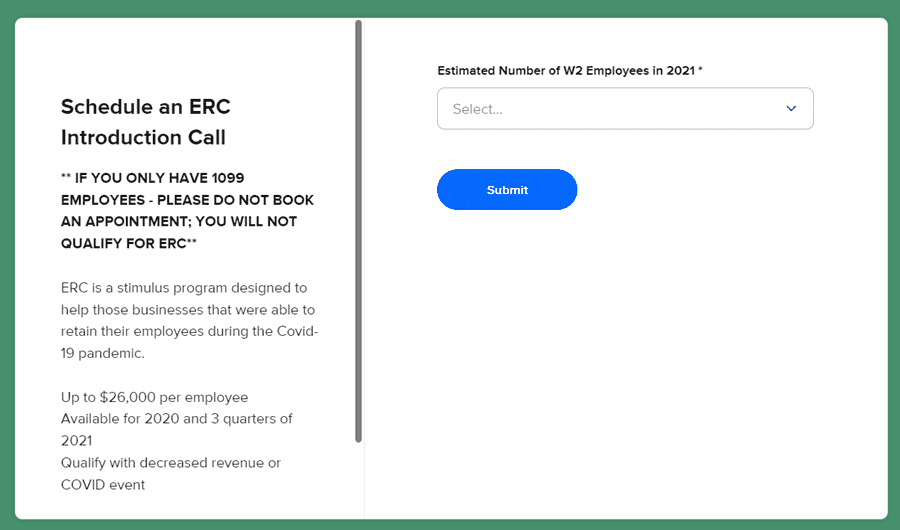

Upon clicking the “CONFIRM” red button below, you testify that you meet the requirements. Then, automatically, you will head to the following page example below to complete the form to schedule your free call so Bottom Line LLC can assess your unique situation.

You can see an example of what it looks like below.

Listen To The Video Message From Mr. Josh Fox | CEO of BLC

Do You Want To Apply For The Employee Retention Credit Tax (ERC) Program?

Start your no-obligation pre-qualification check test to schedule a free call with a specialist. They can process the ERC claim on your behalf, compliant with the regulations approved by the IRS requirements!

Thank You For Your Time!

The ERC Scope Team